- Rating – 4.6

- Min. Deposit: $100

- Max. Leverage: 500:1

- Headquarter: Dublin, Ireland

- Products: Forex, Indices, Commodities, Stocks, Options

Our Take on AvaTrade

Founded in 2006 and headquartered in Ireland, AvaTrade is a multi-licensed forex and CFD broker that offers more than 840 CFDs and vanilla options.

AvaTrade stands out with its diverse platform offering, low trading fees, extensive trading tools, and comprehensive educational content. The broker has also developed a unique risk management tool AvaProtect.

I concluded that AvaTrade is an ideal choice for longer-term day and position traders because of its low swaps and enhanced risk management capabilities. It is also geared towards beginner traders wishing to learn the nuances of technical analysis or engage in copy trading.

AvaTrade Pros and Cons

Pros

- Risk management tool

- Choice of platforms

- CFDs and Vanilla options trading

- Affordable costs

Cons

- High inactivity fees

- Average CFD fees

AvaTrade Highlights

- Robust Fund Security: AvaTrade is regulated in multiple jurisdictions, including by top-tier CBI, ASIC, and JFSA.

- Unique Risk Management Tool: The broker has developed a unique AvaProtect tool that allows full hedging of individual positions.

- Competitive Fees: AvaTrade’s trading and non-trading fees are below the industry average.

- Diverse Trading Platforms: AvaTrade offers three proprietary trading platforms and a mobile app. It also incorporates MetaTrader 4&5, and DupliTrade.

- CFDs and Options Offering: The broker provides over 840 CFDs and options for speculation and hedging against price fluctuations.

- Day and Position Trading: I deem AvaTrade to be perfect for longer-term trading strategies as its swap fees are lower than the industry average.

AvaTrade Regulations

In our reviews, we examine the licenses and regulations of each entity operated by a broker. This allows us to compare their different levels of protection. We rank licenses by various regulatory bodies on a three-tier system, where Tier-1 licensing indicates the highest level of regulation.

This is what I discovered about the seven entities operating under the AvaTrade trade name:

- AVA Trade EU Ltd is licensed and regulated by the Central Bank of Ireland (CBI) under license number C53877. We rate the CBI as a Tier-1 regulator.

- Ava Trade Markets Ltd is licensed and regulated by the British Virgin Islands Financial Services Commission (BVIFSC) under license number SIBA/L/13/1049. We rate the BVIFSC as a Tier-3 regulator.

- Ava Capital Markets Australia Pty Ltd is licensed and regulated by the Australian Securities and Investments Commission (ASIC) under license number 406684. We rate ASIC as a Tier-1 regulator.

- Ava Capital Markets Pty is licensed and regulated by the Financial Sector Conduct Authority (FSCA) of South Africa under license number 45984. We rate the FSCA as a Tier-2 regulator.

- Ava Trade Japan K.K. is licensed and regulated by the Japanese Financial Services Agency (JFSA) under license number 1662. We rate the JFSA as a Tier-1 regulator. The entity is also authorized and regulated by the Financial Futures Association of Japan under license number 1574.

- Ava Trade Middle East Ltd is licensed and regulated by the Abu Dhabi Global Markets (ADGM) Financial Regulatory Services Authority (FRSA) under license number 190018. We rate the ADGM as a Tier-2 regulator.

- ATrade Ltd is licensed and regulated by the Israel Securities Authority (ISA) under license number 514666577. We rate ISA as a Tier-2 regulator.

AvaTrade Trading Fees

AvaTrade Spreads

I tested AvaTrade’s spreads during the most actively traded times – the London open at 8:00 a.m. GMT and just after the U.S. open at 2:45 p.m. GMT. The test was conducted on the 30th of January 2024. The results are shown in the table below:

| Instrument | Live Spread AM | Live Spread PM | Industry Average |

| EURUSD | 0.9 pips | 0.9 pips | 1.3 pips |

| GBPJPY | 2.4 pips | 2.4 pips | 2.3 pips |

| Gold (XAUUSD) | 27 pips | 27 pips | 45 pips |

| Crude Oil | 0.03 pips | 0.03 pips | 0.03 pips |

| Apple | NA | 0.22 points | 0.07 points |

| Tesla | NA | 0.39 points | 0.07 points |

| Dow Jones 30 | 4.0 basis points | 3.0 basis points | 3.5 basis points |

| Germany 40 | 3.0 pips | 2.0 basis points | 2.0 basis points |

| Bitcoin | $65 | $63 | $30 |

Broken down by asset class and compared to the broader industry, AvaTrade offers low spreads on share CFDs, low-to-average spreads on currency pairs and commodities, average spreads on indices, and high spreads on cryptocurrencies.

AvaTrade Swaps

A swap fee is a trader’s cost for holding an open position overnight because of changing interest rates. Swap long refers to the charge deductible or credit receivable for holding a buy position open overnight. In turn, swap short relates to the charges/credits deductible or receivable for holding a selling position open overnight.

The values listed below are for one full contract (100,000 units) of the base currency.

| Instrument | Swap Long | Swap Short |

| EURUSD | Charge of $2.53 | Credit of $0.33 |

| GBPJPY | Credit of $3.07 | Charge of $7.05 |

My findings indicate that AvaTrade’s low swaps accommodate the execution of day trading and position trading strategies, which require multiple days to complete.

Swap-free trading is also possible via AvaTrade’s Islamic accounts.

AvaTrade’s Non-Trading Fees

The broker does not charge a handling fee for deposits or withdrawals. However, third-party banking fees may apply depending on the chosen payment method.

I also discovered that the broker charges a relatively high inactivity fee. After three months of inactivity, the dormant account is charged $50 (or the base currency equivalent). The fee is charged monthly until activity resumes or the account balance drops to zero. After twelve months of inactivity, AvaTrade charges an administration fee of $100.

Are AvaTrade’s Fees Competitive?

Based on my findings regarding AvaTrade’s spreads, commissions, and swaps, I estimated that its trading fees are indeed competitive. The broker’s pricing mechanism is suitable for high-frequency trading when trading instruments from certain asset classes (most FX pairs and share CFDs, some commodities, etc).

The pricing mechanism is also geared towards longer-term trading because of AvaTrade’s low swap charges.

Accounts Comparison

I have compiled the table below to help you better understand the difference between the trading fees on AvaTrade’s retail account type and the industry average. It illustrates the spreads and commissions I have recorded for the EUR/USD pair and compared against the typical costs for ECN and STP accounts in the industry at large.

The table demonstrates how much you would have to pay to trade 1 full lot (100,000 units) in EUR/USD with a pip value of $10 for each account.

To calculate the cost of such a full-sized trade, I used this formula: Spread x pip value+commission

| Account Type* | Spread | Commission** | Net Cost |

| AvaTrade | 0.9 pips | $0 | $9 |

| Typical STP | 1.0 pips | $0 | $10 |

| Typical ECN | 0.2 pips | $6 | $8 |

*The numbers in this chart are only illustrative and subject to change over time

**Round-turn commission

My tests indicate that AvaTrade’s standard account type offers more competitive conditions than the average STP account but slightly worse-off conditions compared to the typical ECN account. This varies depending on the instrument traded.

Platforms and Tools

| Platform/Tool | Suitable For |

| MT4 and MT5 | Automated trading via Expert Advisors (EAs) |

| Ava Web Trader | User-friendly charting capabilities |

| AvaSocial and DupliTrade | Social and copy trading with advanced filters for trading strategies search |

| AvaOptions | Vanilla options trading with better risk management |

| AvaTradeGO | Mobile trading with intuitive design |

| VPS hosting | Faster execution speeds |

| Guardian Angel Suit | Advanced risk-management for MT4 and MT5 |

AvaTrade’s Web Trader platform is a great choice for technical traders interested in price action examination. Its charts are light and flexible, allowing traders to study even minute changes in price action behavior in detail.

The platform incorporates actionable trading ideas directly on its interface, however, it notably lacks some essential features, such as the Elliott Wave drawing tool and alert setting option.

AvaTrade enhances the trading experience with several tools, including the Guardian Angel Suite, an advanced risk management tool that integrates seamlessly with both MT4 and MT5 platforms. The suit is available to AvaTrade clients for free.

AvaTrade’s Web Trader Platform

The AvaTrade Web Trader’s main frame

General Ease of Use

I quite enjoyed exploring the various features of the AvaTrade Web Trader. The platform has a sophisticated instruments search bar for quick and easy search. Its charts are light and detailed, affording traders an intricate glimpse into price action behavior.

Charts

I consider the chart screen a platform’s most important feature. It facilitates technical analysis by providing an overview of price action behavior. Chart artists use many analytical tools and chart configuration possibilities to examine it from multiple angles. In my experience, the really important aspect of a chart is how easy it is to scale price action up and down.

The Web Trader’s chart window

I have broken down the available analytical tools and chart configurations below

- 80 technical indicators. The platform supports trend-based, volume-based indicators, oscillators, and more. These can be applied to study price action behavior and determine the underlying market sentiment. In general, technical indicators are used to gauge where the market is likely to head next. The assortment of 80 technical indicators exceeds the industry average.

- 13 drawing tools. Drawing tools, such as Fibonacci retracement levels and Elliott waves, are used to study repeatable price patterns. Additionally, they can be applied to determine key support and resistance levels and potential breakout or breakdown levels. I was a bit surprised by the relatively low range of drawing tools, and the notable absence of the Elliott Waves tool. Especially given the otherwise very pleasant feel to the charts screen.

- 9 timeframes. The Web Trader allows multi-timeframe analysis of price action behavior. The greater the number of timeframes, the more intricate examinations that can be carried out across the short-term and long-term. The platform’s lowest time frame is 1 minute, which is rather insufficient for successful high-frequency trading (e.g. scalping).

- 3 chart types. Price action can be represented as a line, bars, or candlesticks. This diversity makes it possible to examine potential trading opportunities from different angles.

Orders

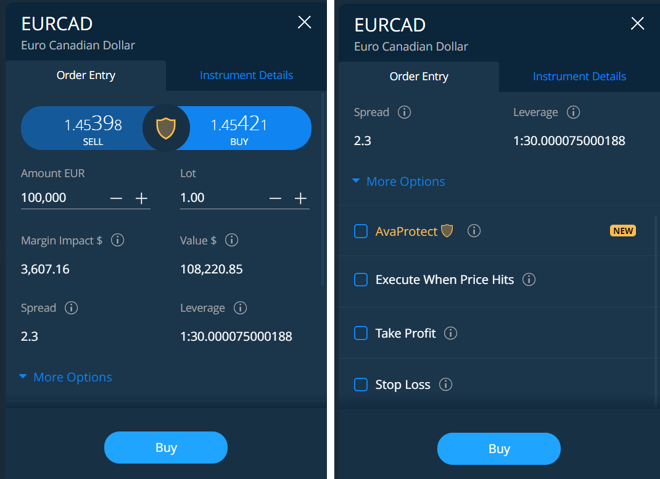

Order placing window

I have broken down the available order types on the Web Trader platform below:

- Market orders. Market orders are used for immediate entry at the best possible price. If triggered, they guarantee volume filling, though there could be a discrepancy between the requested price and the price where the order gets filled.

- Limit orders. Unlike market orders, limit orders guarantee exact price execution. However, a limit order will not be filled if the price action does not reach the pre-determined execution price.

- Stop orders. They are used to support open positions by limiting the maximum loss that can be incurred if the market turns in the opposite direction. A stop-loss order is placed at a fixed price below or above the spot price. If the market does indeed turn and triggers the stop-loss, it will transform into a market order and get filled at the best possible price.

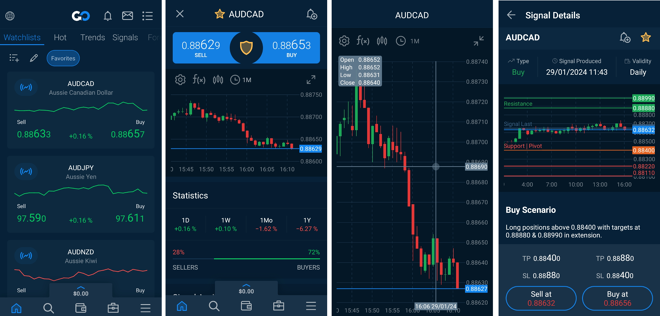

AvaTrade’s AvaTradeGO Mobile App

A watch list (first), an order screen (second), a chart screen (third), and a trading signal (fourth)

The AvaTradeGO mobile app affords traders quick and easy access to the market on the go. It is very useful for monitoring and adjusting open trades. The market is volatile and ever-changing, which is why it is so essential to stay on top of things at all times.

You can use the app to place market, limit, and stop orders, as well as to adjust the exposure of your open trades. Additionally, the app is very convenient for assessing trading signals by TradingCentral.

Tradable Instruments

| Instruments | Number | Types |

| Currency Pairs | 53 | Majors (11), Minors (25), Crosses (17) |

| Commodities | 19 | Metals (7), Energies (5), Agricultural (7) |

| Share CFDs | 603 | USA (494), Canada (21), UK (22), Europe (66) |

| Indices | 34 | USA, Europe, Asia, Other |

| Cryptocurrencies | 19 | Majors and Minors |

| ETFs | 59 | Financial, Commodity, Retail, Other |

| Bonds | 2 | Japan and Europe |

| FX Options | 64 | Currency Pairs, Indices, Commodities |

Compared to the industry average, AvaTrade offers an average amount of currency pairs and cryptocurrencies, and a high amount of commodities, share CFDs, and indices.

What Are CFDs?

Contracts for difference (CFDs) are derivatives used to speculate on the underlying asset’s price without physical delivery. For example, a long position on gold would generate profit as the price rises or incur a loss as it falls, all without the need to purchase actual gold bars. One of the biggest advantages of trading CFDs is that traders can get in and out of the market almost instantaneously, thereby catching even minute changes in the price of the derivative.

Deposit and Withdrawal

| Payment Method | Currency | Fee | Processing Time |

| Bank Wire | USD, EUR, GBP, AUD | $0 | Up to 7 business days |

| Credit/Debit Card | USD, EUR, GBP, AUD | $0 | Instant |

| Skrill | USD, EUR, GBP, AUD | $0 | Up to 24 hours |

| Neteller | USD, EUR, GBP, AUD | $0 | Up to 24 hours |

| WebMoney | USD, EUR, GBP, AUD | $0 | Up to 24 hours |

AvaTrade Withdrawal Methods

| Payment Method | Currency | Fee | Processing Time |

| Bank Wire | USD, EUR, GBP, AUD | $0 | Up to 10 days |

| Credit/Debit Card | USD, EUR, GBP, AUD | $0 | Up to 48 hours |

| Skrill | USD, EUR, GBP, AUD | $0 | Up to 48 hours |

| Neteller | USD, EUR, GBP, AUD | $0 | Up to 48 hours |

| WebMoney | USD, EUR, GBP, AUD | $0 | Up to 48 hours |