- Rating – 4.4

- Min. Deposit: $100

- Max. Leverage: 500:1

- Headquarter: London, UK

- Products: Forex, Stock Indices, Commodities, Bonds, Stocks

Tickmill is not publicly traded and does not operate a bank. Tickmill is authorised by two Tier-1 regulators (Highly Trusted), one Tier-2 regulator (Trusted), zero Tier-3 regulators (Average Risk), and one Tier-4 regulator (High Risk). Tickmill is authorised by the following Tier-1 regulators: Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and regulated in the European Union via the MiFID passporting system.

Founded in 2014 and based in the United Kingdom, Tickmill has rapidly grown from a newcomer in trading into a well-established brand in the financial industry in less than a decade.

I was impressed by Tickmill’s diverse assortment of CFDs, Options, and Futures and the variety of trading platforms, including MetaTrader 4 and 5. The broker also stands out for its competitive fees, ultra-fast execution speeds, integration with Autochartist, and market sentiment tools.

I found Tickmill’s offering to be one of the most well-calibrated for high-volume and high-frequency traders.

Tickmill Pros and Cons

Pros

- Average execution speed of 20 milliseconds

- Below-average trading fees

- Selection of platforms

- Choice of trading instruments

- Robust supporting content and tools

Cons

- No proprietary platform

- Less competitive fees on Classic account

- Basic news feed

Tickmill Regulations

In our reviews, we examine the licenses and regulations of each entity operated by a broker. This allows us to compare their different levels of protection. We rank licenses by various regulatory bodies on a three-tier system, where Tier-1 licensing indicates the highest level of regulation.

This is what I discovered about Tickmill:

- Tickmill UK Ltd is authorized and regulated by the Financial Conduct Authority (FCA) in the UK under license number 717270. It is also authorized by the Dubai Financial Services Authority (DFSA) in the United Arab Emirates as a representative office, with reference number F007663. The FCA ranks as a Tier-1 regulator on our system, while DFSA ranks as a Tier-2 regulator on our system.

- Tickmill Europe Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 278/15. CySEC ranks as a Tier-1 regulator on our system.

- Tickmill South Africa (Pty) Ltd is licensed and regulated by the Financial Sector Conduct Authority (FSCA) in South Africa with license number FSP49464. The FSCA ranks as a Tier-2 regulator on our system.

- Tickmill Asia Ltd is authorized and regulated by the Financial Services Authority (FSA) of Labuan Malaysia under license number MB/18/0028. The FSA ranks as a Tier-2 regulator on our system.

- Tickmill Ltd is regulated and licensed by the Financial Services Authority (FSA) of Seychelles under license number SD008. The FSA ranks as a Tier-3 regulator on our system.

Tickmill’s Trading Fees

Tickmill’s Spreads

I tested Tickmill’s spreads during the most actively traded times – the London open at 8:00 a.m. GMT and just after the U.S. open at 2:45 p.m. GMT. The test was conducted on 7 November 2023. The results are shown in the table below:

| Instrument | Live Spread AM | Live Spread PM |

| EURUSD | 0.1 pips | 0.3 pips |

| GBPJPY | 0.8 pips | 0.6 pips |

| Gold (XAUUSD) | 11 pips | 7 pips |

| Crude Oil | 0.03 pips | 0.02 pips |

| Apple | NA | 0.06 points |

| Tesla | NA | 0.13 points |

| Dow Jones 30 | 2.2 basis points | 1.4 basis points |

| Germany 40 | 0.8 basis points | 0.8 basis points |

| Bitcoin | No instrument | No instrument |

Broken down by asset class and compared to the broader industry, Tickmill charges below-average spreads on instruments across all major asset classes. I was especially impressed by the low spreads I measured on gold and the two stock indices.

Tickmill’s Commissions

Traders who open a Pro account with Tickmill have to pay a $2 per side ($4 round-turn) commission for executing a full-sized position (100,000 units). This commission rate is below the industry average of $3 per side and is suitable for high-frequency trading. The classic account is a commission-free account while the commission for the VIP account is set at $1 per standard lot.

Tickmill’s Non-Trading Fees

Tickmill does not charge a handling fee on deposits or withdrawals, though third-party banking fees may apply. It, however, has an inactivity fee of £10 charged on accounts on which no activity has been registered for one calendar year. The fee is charged monthly until activity resumes or the account balance drops to £0.

Are Tickmill’s Fees Competitive?

Tickmill’s fees are indeed very competitive. I found them suitable for the implementation of a wide variety of trading strategies. The combination of low spreads, especially on commodities and indices, and low fixed commissions is especially suitable for high-frequency and high-volume trading, which require frequent getting in and out of large-scale positions (scalping).

Accounts Comparison

I have compiled the table below to help you better understand the difference between the trading fees on Tickmill’s three CFDs accounts. It illustrates the spreads and commissions I have recorded on the EUR/USD pair on the Classic, Pro, and VIP accounts. The table shows how much you will have to pay to trade 1 full lot (100,000 units) on the EUR/USD with a pip value of $10.

To calculate the cost of such a full-sized trade, I used this formula:

Spread x pip value+commission

| Account Type* | Spread | Commission** | Net Cost |

| Classic Account | 1.7 pips | $0 | $17 |

| Pro Account | 0.2 pips | $4 | $6 |

| VIP Account | 0.2 pips | $2 | $4 |

*The numbers in this chart are only illustrative and subject to change over time

**Round-turn commission

Given that the industry average net cost fluctuates around $10, my tests indicate that Tickmill’s Pro and VIP accounts have very favorable trading fees. The main difference is their accessibility. The Pro account has a minimum deposit requirement of $100, making it quite affordable for all kinds of retail traders. In contrast, the VIP account has a minimum balance requirement of $50,000, rendering it available only to more affluent traders.

Platforms and Tools

In this review, I evaluated the MetaTrader 5 platform, notable for its extensive features, including a remarkable selection of 21 timeframes. This aspect especially distinguishes it from other retail trading platforms. It also has an intuitive strategy tester tool, making it possible for algo traders to automate their strategies. Tickmill is especially suitable for algorithmic trading due to its fast execution speed (around 20 milliseconds). I, however, have some reservations about the platform, primarily stemming from its rugged design.

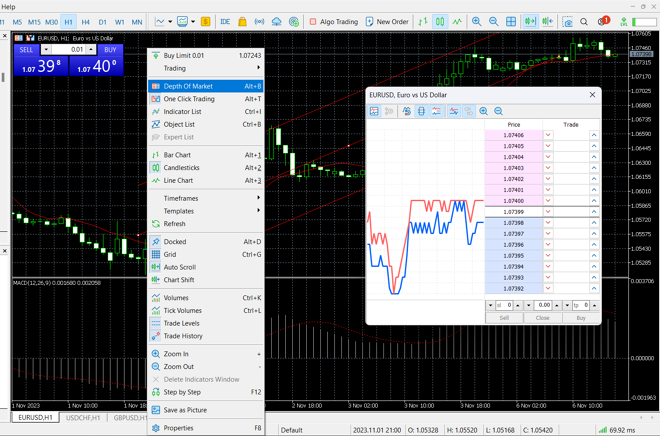

MetaTrader 5’s depth of market feature

When you right-click on MT5’s chart screen, you get a dropdown menu with some of its key features. As shown above, the platform supports one-click trading, which is essential for high-frequency trading strategies. The platform also has other highly practical features, such as the possibility to set alarms and the depth of the market tool.

Tickmill also offers multiple MT4&5 plugins and toolkits for enhanced trading, such as a correlation matrix, market sentiment tool, session map, and more.

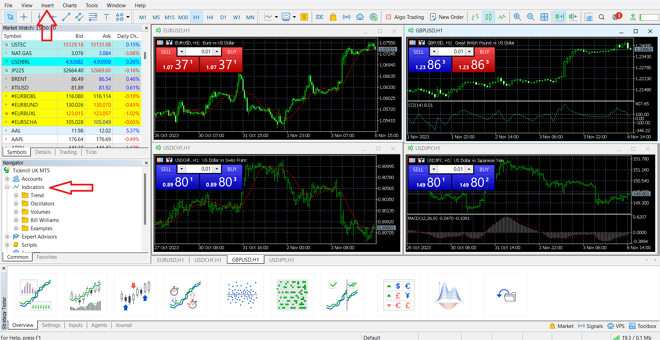

Tickmill’s MetaTrader 5 Desktop Platform

The general outlook of MetaTrader 5

General Ease of Use

The platform has a very familiar layout. The watch list and screen navigator tools are positioned on the left-hand side, the charts screen is on the right-hand side, the strategy tester and other account info panes are at the bottom, and a panel of available settings can be found at the top. The arrows on the image above indicate where you can access all the available technical indicators and drawing tools.

Charts

I consider the chart screen a platform’s most important feature. It aids technical analysis by providing an overview of price action behavior and allows traders access to a range of analytical tools and chart configuration possibilities. A good chart should afford easy scaling up and down of price action.

MetaTrader 5’s chart window

I have broken down the available analytical tools and chart configurations below:

- 38 technical indicators. The platform supports trend-based, volume-based indicators, oscillators, and more. These can be applied to study price action behavior and determine the underlying market sentiment. In general, technical indicators are used to gauge where the market is likely to head next.

- 24 drawing tools. Drawing tools, such as Fibonacci retracement levels and Elliott waves, are used to study repeatable price patterns. Additionally, they can be applied to determine key support and resistance levels and potential breakout or breakdown levels.

- 21 timeframes. The platform affords multi-timeframe analysis of price action behavior. The greater the number of timeframes, the more intricate examinations that can be carried out across the short-term and long-term.

- 3 chart types. MT5 makes it possible to represent price action as a line, area, or using candlesticks. This diversity makes it possible to examine potential trading opportunities from different angles.

Orders

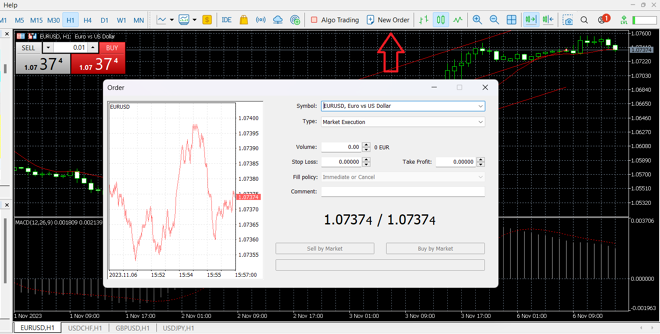

An order placing window on MetaTrader 5

I have broken down the available order types on the MetaTrader 5 platform below:

- Market orders. Market orders are used for immediate entry at the best possible price. If triggered, they guarantee volume filling, though there could be a discrepancy between the requested price and the price where the order actually gets filled.

- Limit orders. Unlike market orders, limit orders guarantee exact price execution. However, a limit order will not be filled if the price action does not reach the pre-determined execution price.

- Stop orders. They are used to support open positions by limiting the maximum loss that can be incurred if the market turns in the opposite direction. A stop-loss order is placed at a fixed price below or above the spot price. If the market does indeed turn and triggers the stop-loss, it will transform into a market order and get filled at the best possible price.

Tradable Instruments

I have broken down the available instruments with Tickmill below:

- 62 Currency Pairs

Major, Minor, Exotic - 11 Commodities

Metals and Energy - 494 Share CFDs

Finance, Tech, Retail, Other - 23 ETFs

Europe, U.S., Other - 20 Indices

UK, Europe, U.S., Asia, Other - 9 Cryptocurrencies*

Majors and Minors - 4 Bonds

Europe - 124 Futures and Options

Indices, Interest Rates, Metals, Energy, Other

*For Tickmill UK Ltd crypto trading is available to Professional Clients only

Compared to the broader industry, Tickmill offers an average amount of FX pairs and commodities and a high amount of share CFDs and indices.

Compared to the broader industry, Tickmill offers an average amount of FX pairs and commodities and a high amount of share CFDs and indices.

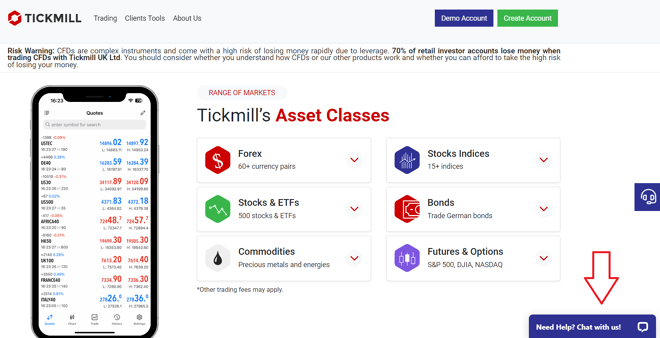

Customer Support

The live chat option is available from the bottom-right corner of the main page. Before you get in touch with an agent, you have to fill in your name and email address and choose a preferred language. Alternatively, you can use one of the other available contact channels listed here.

Tickmill’s live chat option

Tickmill Customer Support Test

When we test a broker’s customer support team, we evaluate the agent’s knowledge of their own website, how long it takes them to respond to questions, and how detailed their answers are.

I conducted my test on the 8 November at around 10:57 am CET via live chat. An agent connected almost instantaneously after I submitted my query. Initially, I asked about Tickmill’s execution model and received a straightforward answer shortly afterward.

The agent was polite and well-informed on a range of topics. He did not take long to respond to my several queries. I had a very positive overall impression of Tickmill’s customer support.

Deposit and Withdrawal

Tickmill’s Deposit Methods

| Method | Currency | Min. Transaction | Fee | Processing Time |

| Credit/Debit Card | USD, EUR, GBP, PLN | 100 | $0 | Instant |

| Wire Transfer | USD, EUR, GBP, PLN, CHF, ZAR | 100 | $0* | Within 1 business day |

| Skrill | USD, EUR, GBP, PLN | 100 | $0 | Instant |

| Neteller | USD, EUR, GBP, PLN, CHF | 100 | $0 | Instant |

| Przelewy24 | PLN | 100 | $0 | Instant |

| Sofort | EUR, GBP | 100 | $0 | Instant |

| Rapid | EUR, PLN, GBP, USD | 100 | $0 | Instant |

| PayPal | USD, EUR, GBP, PLN, CHF | 100 | $0 | Instant |

*$0 Tickmill covers banking fees on wire transfers above $5,000

Tickmill’s Withdrawal Methods

| Method | Currency | Min. Transaction | Fee | Processing Time | Estimated Arrival |

| Credit/Debit Card | USD, EUR, GBP, PLN | 25 | $0 | Within 1 working day | Up to 8 business days |

| Wire Transfer | USD, EUR, GBP, PLN, CHF | 25 | $0 | Within 1 working day | 2-7 business days |

| Skrill | USD, EUR, GBP, PLN | 25 | $0 | Within 1 working day | Instant |

| Neteller | USD, EUR, GBP, PLN, CHF | 25 | $0 | Within 1 working day | Instant |

| Przelewy24 | PLN | 25 | $0 | Within 1 working day | Within 1 business day |

| Sofort | EUR, GBP | 25 | $0 | Within 1 working day | Not specified |

| Rapid | EUR, PLN, GBP, USD | 25 | $0 | Within 1 working day | Not specified |

| PayPal | USD, EUR, GBP, PLN, CHF | 25 | $0 | Within 1 working day | Not specified |

Tickmill processes all payments (deposits and withdrawals) within a single business day. However, some transactions may take up to 8 business days to reflect in your bank account. Notably, Tickmill covers banking fees on deposits via bank wire above $5000.

Deposit and withdrawal methods vary depending on the entity.